Inspiration

Inspiration at your fingertips

Ready to ignite your imagination? Welcome to our inspiration hub, where creativity knows no bounds! Discover captivating stories of our display homes, and custom-designed wonders, and gain valuable building advice. Get a regular supply of design tips and insights for all things home, interior, and building.

Socials

Let us introduce you to our five Coastal Faves, designed to ride the wave of inspiration:

🌴 There’s the Cali Crib, capturing the laid-back Californian lifestyle.

🌿 Opulent Eden is your tropical coastal paradise!

🌼 Embrace your free spirit with Bohemian Lush.

🐎 Make a statement with the bold Show Pony, designed for narrow lots.

☀️ Bask in the warmth of coastal living with the Sunbeam Sanctuary.

Explore the new Coastal Faves collection and find the one that speaks to you. For more design inspiration visit Modern Home Designs Perth | Residential Attitudes.

Proud member of the @jwhgroup

#residentialattitudes #livewithattitude #jwhgroup

Got yourself a squat lot? That doesn’t mean your design choices are limited!

Take a look at our Tech Modern design – it makes the most of every corner with generous ground-floor rear living and three large bedrooms and a retreat upstairs. No compromise!

Explore more on our website. Link in bio.

Proud member of the @jwhgroup

#residentialattitudes #livewithattitude #jwhgroup

If our Mid Century North Perth home doesn’t light you up with a warm glow, nothing will!

It’s all about the free-flowing, open-plan design and those unique finishing touches, like the outdoor firepit (perfect for cooler autumn nights). 🔥

Proud member of the @jwhgroup

#residentialattitudes #livewithattitude #jwhgroup

Introducing The Muse, where every detail inspires.

Parents can find solace in a serene ground-floor sanctuary, featuring a walk-through dressing area and spa-like ensuite for relaxation and inspiration.

Upstairs, children have space to roam and explore in three bedrooms and a cosy sitting area, nurturing their imaginations.

Opening hours: Open Sat & Sun 1-4pm.

View at 31 Overland Approach, Wanneroo.

Proud member of the @jwhgroup

#residentialattitudes #livewithattitude #jwhgroup

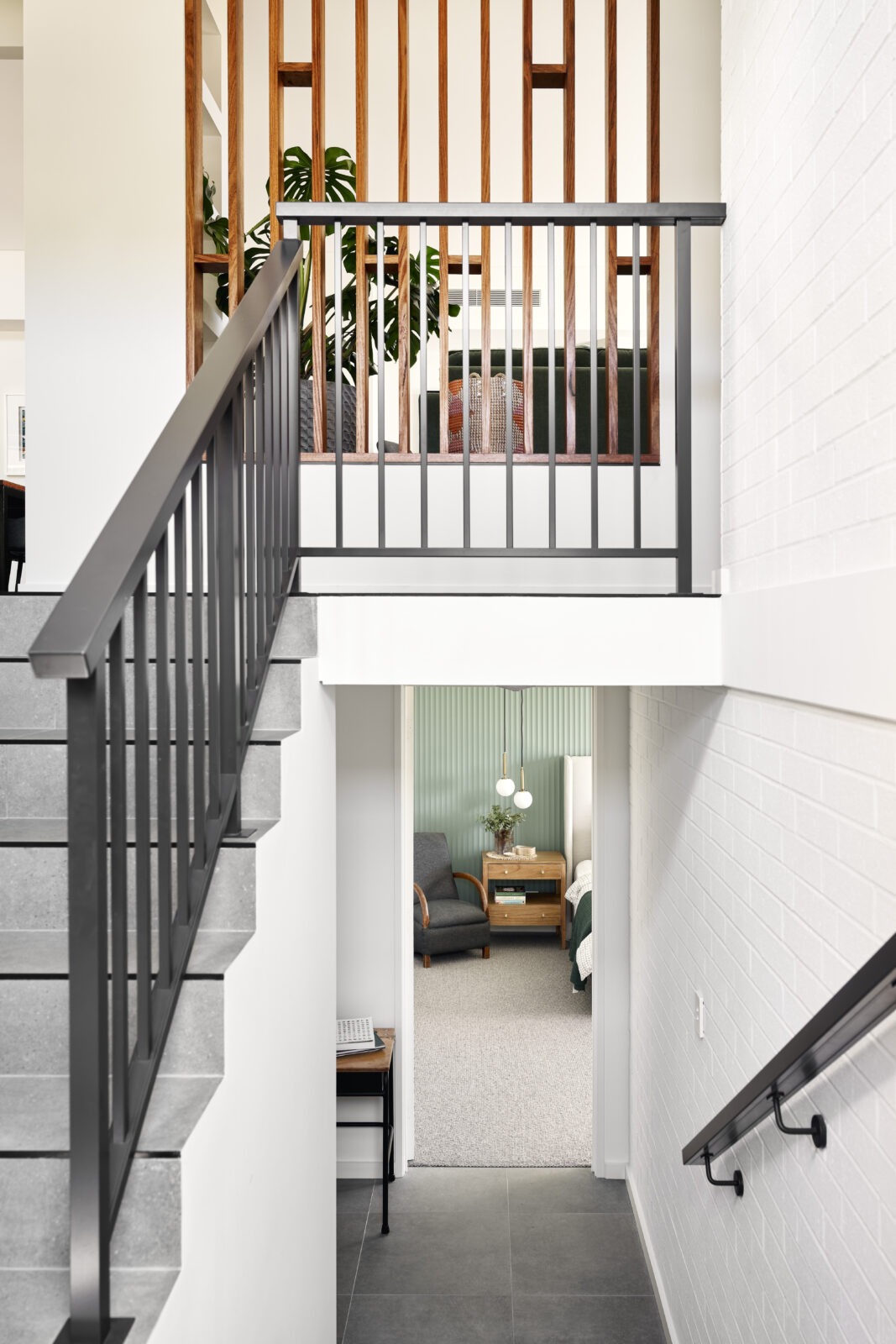

Maximise your space without expanding land! 🏠

As land in Perth becomes scarcer and lot sizes shrink, modern two-storey home designs are becoming extremely popular for their ability to maximise your square footage without increasing how much land you need.

Dive into our latest blog to discover the key features and elements essential for creating a well-planned modern two-storey home. Link in bio.

Proud member of the @jwhgroup

#residentialattitudes #livewithattitude #jwhgroup

Our double-storey designs do it all.

Whether you want to capture the views or create space for older children, adding an upper floor is the way to do it. Even better, you can expand your interior square footage without losing any of your backyard.

Proud member of the @jwhgroup

#residentialattitudes #livewithattitude #jwhgroup